Thought Leadership

Summer Transfer Window 2022: TFG’s Analysis

9 MIN READ

Thought Leadership

Inspired by what you’re reading? Why not subscribe for regular insights delivered straight to your inbox.

The winners, losers, best value deals, deals to watch and market trends: TFG’s summer window 2022/23 analysis

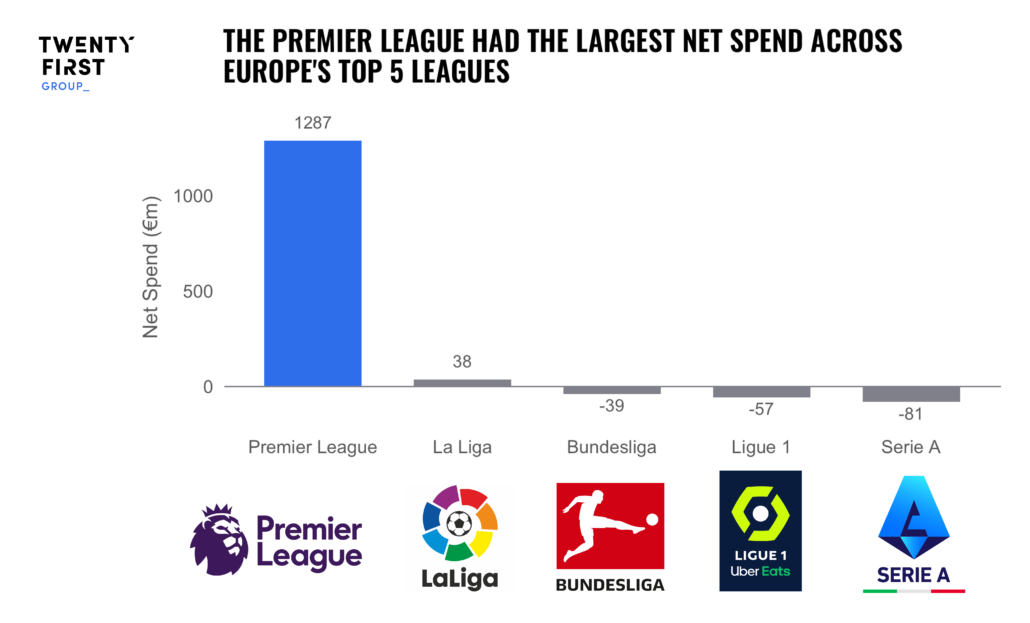

The summer’s transfer window highlighted the Premier League’s place in the hierarchy of domestic leagues, with record levels of spending in stark contrast with the financial situation at many other clubs around Europe and more broadly around the world. Premier League clubs collectively spent more than the other four major European leagues combined (£2.11b vs £2.06b), and despite high levels of income generated too, it had comfortably the biggest net spend of any major European league.

With so much money spent, it becomes even more critical to review the window’s impact, using our Intelligence Engine to understand the likely winners and losers and key trends in the market.

The Winners and Losers

Winners

According to our player and projection models, Chelsea were one of the winners of the window, with their business improving their title odds by 6% and their top four chances by 13%, the most of any club. As with Chelsea, Manchester United’s signings have also had a positive impact on their Champions League qualification chances, improving them by 12%.

There was a lot of interest in Leeds United’s transfer window when they sold key players Kalvin Phillips and Raphinha to Man City and Barcelona respectively, but our models suggest that they have re-invested the money they received for those transfers wisely, building a more balanced squad with greater depth across the pitch and improving their relegation chances by 10%, the most of any team in the Premier League.

Losers

Without question the club who faced the biggest challenges in the transfer window was Bournemouth. A combination of their rivals strengthening their squads and limited improvements made themselves has seen their relegation chances increase by 17%, comfortably more than any other side.

Due as well in large part to the investment made by rivals, Liverpool saw one of the biggest drops in end-of-season prospects through the course of the window. Despite the big money signing of Darwin Nunez, the signing of Fabio Carvalho, and the deadline day arrival of Arthur Melo, our models suggest that there has been a 20% drop in Liverpool’s chances of finishing in the top 4, although they still remain second-favourites behind Manchester City. The loss of Sadio Mané is also a contributing factor here.

With the transfer window being a dynamic and complex environment in which to deal, having a complete understanding of rivals’ activities – and the impact that is likely to have on your own team – can help clubs better plan and react during their transfer windows.

The Best Value Deals and Deals to Watch

Our Player Valuation Model allows us to understand what a ‘fair’ value is for players in an efficient, rational market place. However, context and circumstances mean players may not always sell for this value, enabling us to identify the players who were signed for good or over-valued deals. While it is important to acknowledge the role of player salaries in evaluating the overall financial impact of a transfer, these types of models enable clubs to get an initial understanding of the value for money they are getting in the market.

The Best Value Deals

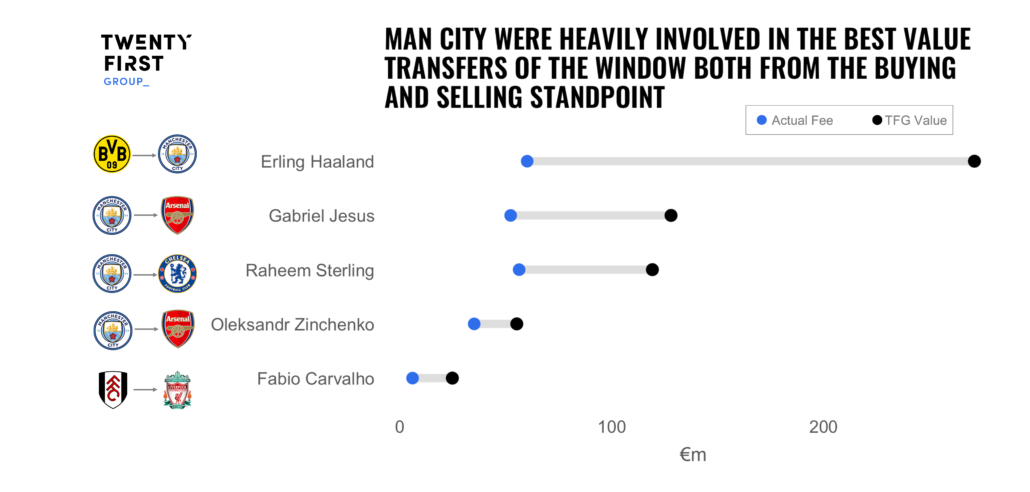

The highest-profile transfer of the summer was Erling Haaland, who moved for a reported £51m to Manchester City. Players like Haaland are almost impossible to value; in the last 10 years only Kylian Mbappé and Neymar have performed at a similar level at the same age, and it is therefore unsurprising that they are also the two most expensive footballers in history. Given these benchmarks, and the growth in Premier League income and spending since 2018, it is safe to say that a fair market value for the Norwegian is in excess of £200m.

Man City also feature in the next three best value deals of the summer; however this time from the sell side, with Gabriel Jesus (£76m), Raheem Sterling (£63m) and Oleksandr Zinchenko (£20m) all leaving the Etihad for fees significantly less than their objective market value. While this may seem surprising, a closer look shows that both Jesus and Sterling were in the final year of their contracts, significantly weakening Man City’s negotiating position, while Zinchenko was into the final two years of his deal. A similar explanation can be applied to fifth best value deal; Fabio Carvalho’s move to Liverpool from Fulham upon the end of his contract at Craven Cottage.

Deals to Watch

According to our player value model, Wesley Fofana’s £80m move from Leicester to Chelsea, was £63m over our Player Valuation Model’s value to secure his signature. This discrepancy is driven by the fact that it is very rare for Champions League clubs to pay such a large transfer fee for a defender from a mid-table club with just 7 league appearances in the previous season – even if this was largely due to injury. If Fofana can recover full fitness and return to his 2020/21 form, then his value may trend upwards again. The same can also be said of Kalvin Phillips’ move to Man City from Leeds, with City paying £36m over market value. However, like Fofana, Phillips suffered a disrupted season with injuries which is likely to have impacted his market value rating, and the fact that he is a homegrown player is also likely to have impacted the final price.

Meanwhile Manchester United’s move for Antony was £44m over our assessment of his market value, with the fees paid for Lisandro Martinez and Casemiro also more than their ‘fair’ market valuations. Nevertheless, these signings have boosted Manchester United’s overall chances of a top four finish, and if the club can consistently qualify for the Champions League off the back of these signings, then they are likely to eventually emerge as good-value deals.

While time will tell as to whether these players prove to be bad value or not, having an idea of a player’s market value can help buying clubs avoid paying over the odds for players.

Market Trends

This summer has seen a greater percentage of total transfer fees spent on centre backs than at any other point in the last decade (21% v 16% between 2010-22). A closer look at this trend also shows that left footed centre backs have had a small premium over the last three years, having cost less between 2010-19. The transfers of Lisandro Martinez, Sven Botman and Nico Schlotterbeck, are prime examples from this summer.

While it is challenging to identify what the reason for this trend might be, it could be a reflection of teams placing an even greater emphasis on playing out from the back, and wanting a better balance in defence to facilitate this.

In other positions, we might also be seeing a return to more traditional wingers after a decade of an emphasis on inverted wingers, with left footed left wingers now being valued higher than right footed left wingers. On the other flank, while left footed right wingers might remain more expensive than right footed ones, the gap is much less so than before.

Conclusion

As with any transfer window it will be interesting to see how the players who have moved over the course of the summer fare at their new clubs and how successful clubs have been in replacing any departures and integrating new signings into their squad. When you also throw in a break in the domestic schedule of many leagues as a result of a first-ever mid winter World Cup and therefore less games before the January transfer window opens, it is set to be an intriguing first few months of the season.

The use of performance data can help clubs to identify the right players at the right price, providing insights into any market trends and predicting the impact that player transfers could have on the season.

If you would like to find out more about how data can help with transfers and our performance intelligence services, please get in touch with Omar Chaudhuri.