Thought Leadership

Off The Pitch Interview: One metric tells a significant story about the challenges the new owners of Liverpool and Man Utd will face

13 MIN READ

Thought Leadership

Inspired by what you’re reading? Why not subscribe for regular insights delivered straight to your inbox.

Only time will tell if the Mykhaylo Mudryk transfer from Shakhtar Donetsk to Chelsea FC is to become a prime example of how things should be done – or more likely – a lesson in how you should never, ever do transfers as a football club.

This interview is not about Chelsea, and AJ Swoboda, managing director Americas at Twenty First Group, didn’t even mention the above transfer when he spoke to Off The Pitch – probably because when the interview took place it looked very much as if the promising young Ukrainian offensive player was going to sign for Arsenal. But a last-minute intervention from Chelsea meant he ended up signing a 8.5 year deal with the Stamford Bridge club.

There is a whiff of desperation around this transfer Chelsea made when they were sitting 10th in the table and burdened with a long injury list. But ahead of the transfer being confirmed, Swoboda made a comment that stood out:

“It is not about WHO you sign – but HOW you sign players.”

The director of Twenty First Group explained that what he meant was the fact, obvious maybe, that behind every success in business or in football lay in the ability to hire the right people, establish the right processes, and learn from your mistakes.

“If you are good as an owner at hiring and setting strategy, then you will be successful. Your sports club must have a multi-year strategy to guide decisions, and an evidence-backed process to evaluate the degree to which each decision allows the club to progress along its strategy,” says Swoboda.

He explains that in recruitment and squad planning, this approach allows clubs to successfully move through transfer windows with plenty of optionality. It allows owners and executives to learn from past decisions. If a club does not have a proper strategy and process feeding into recruitment, the club exposes itself both to paying too much in transfer fees and wages, and to not learning from its mistakes.

“When it comes to recruitment, owners must understand that there is never just one player out there that can solve all your problems. There is no player with such unique skills that it is worth signing this – and only this – specific player at any cost.”

Actually, the interview with Swoboda was about how he and Twenty First Group, the B2B sporting intelligence firm founded 10 years ago, would begin to describe the reality for new potential owners of either Liverpool FC or Manchester United, since both clubs are currently up for sale. You can find several investment banks out there who can execute traditional due diligence work looking at the financial and strategic weaknesses and strengths of both clubs.

But unlike banks concerned with whether a transaction completes, Twenty First Group are concerned with what will happen for the years to come. So they provide unique sporting intelligence, which helps potential owners cast new light and perspective on the assets they might be willing to buy and own for years, if not decades.

According to Swoboda, for a start, every potential new owner of a football club needs to understand that they are not buying an asset which can be evaluated in a similar manner to traditional businesses. Sports clubs might have revenue streams that can seem rather predictable historically, but the commercial viability of those assets depends inherently on how well the sporting entities, the teams themselves, are performing on the pitch.

“I would argue that many investors, even sophisticated investors, don’t conduct sufficient due diligence prior to buying a football club. This isn’t their fault, as the majority don’t know where and how to look. In the case of Liverpool and United, you might have a unique and innovative understanding of all the business areas of a football club: the income streams from broadcasting, match day, sponsorship and merchandise,” he says and continue:

“But if you don’t explicitly understand how to build and run a successful football team in the best league in the world over consecutive seasons, then it doesn’t really matter if you are best-in-class at everything on the commercial side. You’ll be spending all your energy and money on matters that likely distract you from your original intentions with the asset,” he says and continues:

“The sporting product – which we analyse through our own models – is going to dictate your entire reality. So you better understand it thoroughly before investing. And then you better get it right once you’ve invested.”

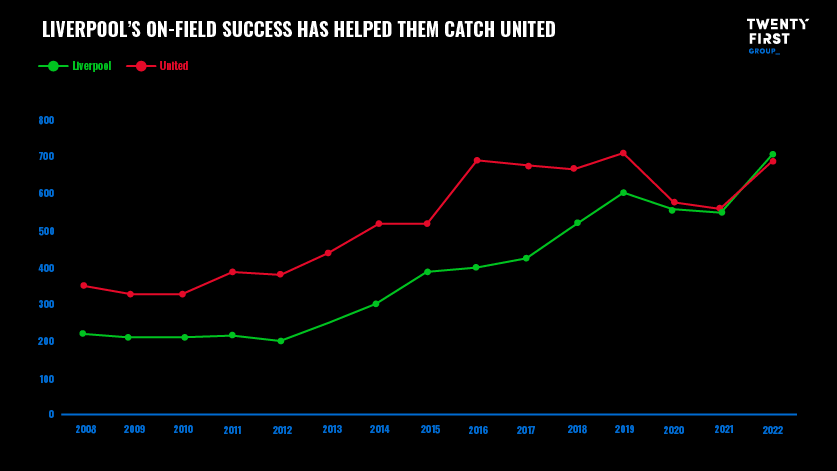

Swoboda says that looking from the outside, Manchester United and Liverpool FC may seem like two similar assets. Obviously, there are differences, but both clubs are just 30 miles apart, both with significant training grounds, historic stadiums, global brands, and global fan bases to name a few.

“We don’t exactly view them as comparable. While the assets might seem similar, what an investor would be buying into is in fact complete opposite, and my view would be that they would attract two very different kind of investors,” says Swoboda.

In football, they have had the ambition to develop a nuanced metric capable of measuring how competitively a team is performing at any point in time. It is not enough to look at the league tables or build price-per-point calculations, as they don’t provide the kind of in-depth knowledge that club owners and investors are looking for in today’s modern world.

Twenty First Group is constantly developing its performance metrics and stress testing their predictiveness against the markets. Even though Swoboda wouldn’t “bet money via that metric and expect to make a fortune, I would definitely sleep well at night”.

It turns out that wage spend is a very strong measure of performance in football – and in fact has one of the best correlations with performance of any singular metric, much stronger than transfer spend. That said, it is not a perfect predictor of performance. There are clubs who ‘earn’ and ‘waste’ significant sums of money due to how they make decisions.

In this context, if you are considering buying either a minority or a majority stake in Manchester United or Liverpool FC, one of the most critical pieces of information to understand when walking into such an investment is the asset’s state of performance and wage efficiency, and how these compare to your appetite and ambitions for the future.

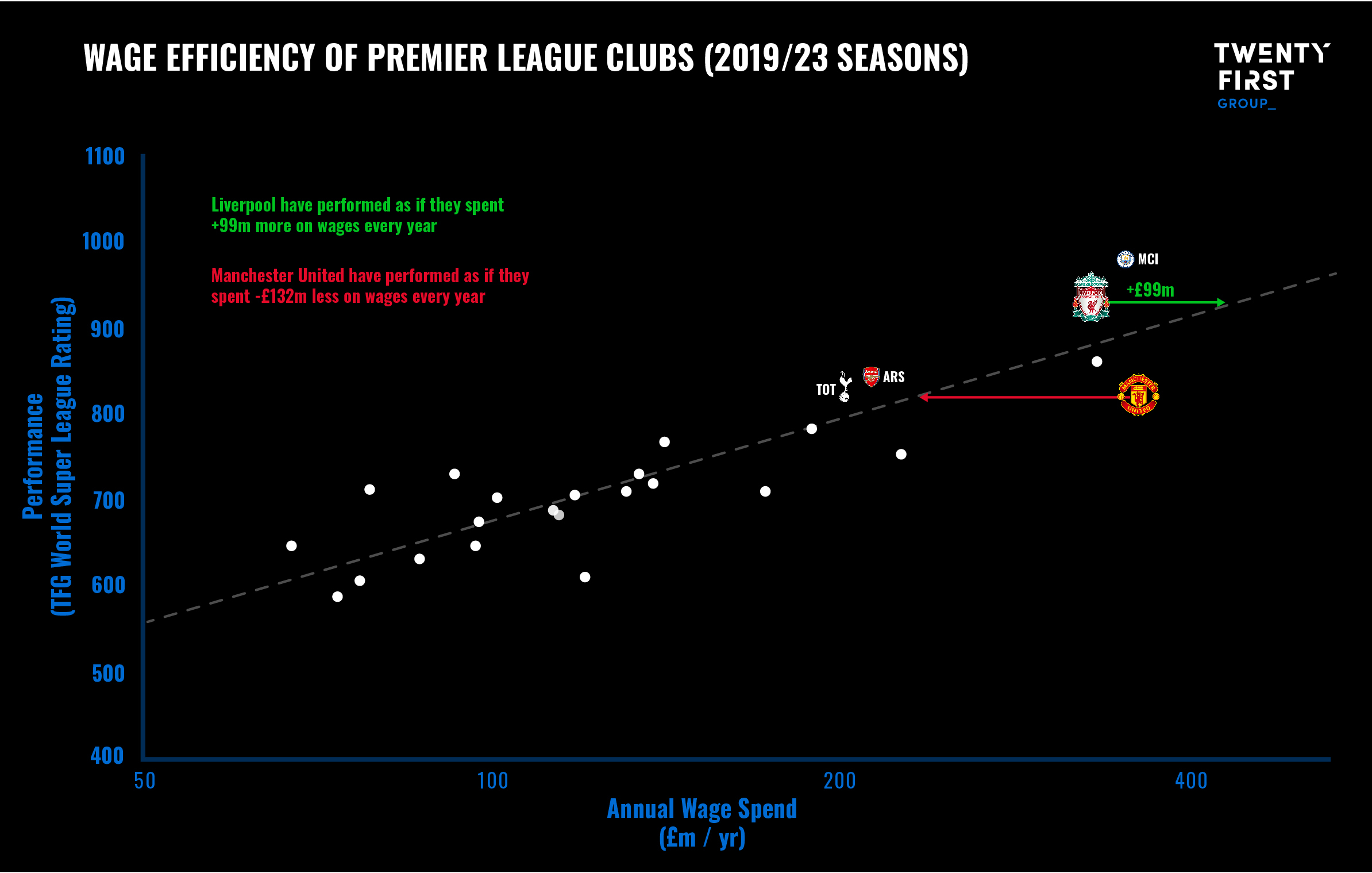

Exploring the wage efficiency of Premier League clubs for the last 3.5 seasons, we can see certain clubs above and below the “efficient line” – or in other words, the on-pitch performance we would expect to see of an average club spending a certain amount of money.

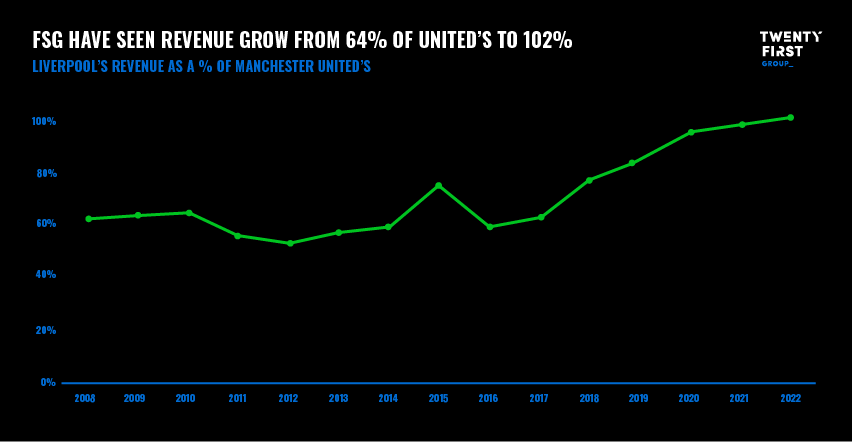

Taking a closer look at Liverpool FC, the data show they have performed at a level over the last four seasons as if they had spent an additional £99 million each year on wages, whereas Manchester United are in the opposite situation, effectively wasting £132 million in wages every year.

Then the key question would be, how should you read these numbers as a potential new owner of one of the clubs?

“Naturally any new owner would want to find out how you get above that wage-efficient line. If you were specifically evaluating Manchester United and you realised that you could save £132 million each year if you started to spend your money as effectively as your average peer, then I would consider that as massive potential,” says Swoboda. “Assuming a potential 10-year ownership period, getting that right can be a £1bn decision.”

He says the perspective from a Liverpool point-of-view would be very different, such that as a potential new owner might be reluctant to buy a majority of shares outright.

“Liverpool’s owners know how to spend their money wisely. They have been truly excellent at ensuring every pound they spend is worth more than many of their rivals. So how do you, as a new control owner, improve that capacity even further? Can you actually do that from day one? How long does it take to get that right?”

“On the other hand, Liverpool likely have larger growth potential across their commercial revenue streams. So as an investor, you would be happy structuring a deal where you could let the current ownership and management team get on with things – or at least learn from them over a transition period. Manchester United is the opposite case. Possibly the worst thing you could do as an investor is come in to that club with a minority position. For every pound you hand them, one-third of that would vanish instantly due to whom you’re transferring your capital.”

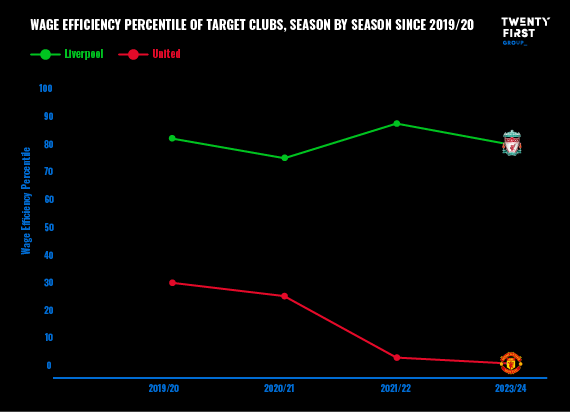

According to Swoboda, the absolute key point in the diligence process is that any potential owner of either Manchester United or Liverpool FC understands all the elements at play behind this wage efficiency metric. “What is the baseline efficiency of the club? What is driving this? How has that efficiency been trending in recent seasons? Why is that?”

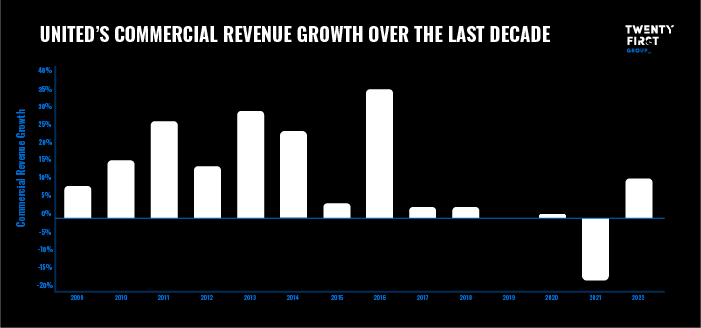

“For a start, we must buy into the basic understanding and acceptance that sports clubs cannot significantly grow their revenues if they don’t produce and maintain a successful sporting product. Look at the impressive market position Manchester United have built worldwide over the last 20 years and ask yourself how they managed to do so? Because they were a title-winning machine under Sir Alex Ferguson.”

He believes that all those titles gave them a unique platform to build a global brand.

“I sincerely don’t believe they would have been able to do that if their results had been mediocre or regularly inconsistent. But once a club establishes its commercial footprint, it is easier for the club to maintain that revenue generation during periods of inadequate sporting performance.”

The other point you need to clearly understand as an owner is what lies behind those clubs who are constantly outperforming their peers on wage efficiency – a club such as Brentford perhaps.

“Run your football club like a Fortune 100 business, where your supporters are your most loyal customers. This doesn’t mean be a dispassionate owner. This means invest in building a clear long-term vision and strategy for the club. This means hire super-bright business and sporting decision makers who can be appropriately empowered to run your club. And of course, this means build efficient structures and processes that are designed to help you to stay on course. Results aren’t guaranteed to come fast or easy,” says Swoboda.

In terms of ability to be consistently and highly efficient with your spending, everything comes down to a combination of strategy and reflection in the sporting department.

He says that as a top European football club, you would need a clearly-defined strategy and system for identifying and hiring sporting talent. And in this very competitive market, this system and the IP within it will likely evolve as your ownership tenure matures at the club.

“You need to accept that you will lose out on some very interesting players by sticking to your strategy and budgets. If you have a defined process, updating theses as you go, then you will win in the long run. Many clubs do have a version of these systems in place, but they may not be based on real-life evidence or the clubs may not have the ability or discipline to stick to them. In a stressful transfer window or opportunistic point in their club’s trajectory, they can end up making decisions which take them off course and cost them dearly in the long run.

The director of Twenty First Group explains that he does not encourage executives to be stubborn and ignore the dynamics of the market.

“For example, the system you set up in your recruitment department might be correct and work out brilliantly, but it doesn’t prevent you from making bad decisions. For every bad decision, you need to have a reason why you made a certain decision. Then you can reflect on the result of that specific decision and how it may impact your strategies. If you don’t have clear reasoning behind your decisions, then you will never be able to learn from them; they become ultimately influenced by random inputs and fleeting priorities. Making decisions repeatedly in a vacuum of real multi-year strategy will ultimately lead to failure for your club.”

Swoboda acknowledges he previously said that owners need to understand that they are not buying a traditional business during the investment process. But he would nevertheless encourage them to run their sports clubs it as if they were businesses.

“In a traditional business, and especially in the best-performing businesses globally, they never ever roll the dice on decisions and hope for a great outcome. They have an extremely detailed set of strategies and processes, which allow their executives to learn and update their direction as they go from being inefficient to being super-efficient in a specific market,” he says.

That is what all the potential new owners of Liverpool and Manchester United must be doing today.

“Deeply understand where these two clubs are now, why they are where they are now, and what it really takes to change them. This is probably the hardest thing. To understand how much work you need to put in, and where you need to do that work, before you are routinely performing brilliantly.”

If you would like to find out more about Twenty First Group’s Investment Intelligence services, please get in touch with AJ Swoboda.

This article was originally published by Off The Pitch.