Thought Leadership

UEFA Champions League Restructure: What impact will it have?

11 MIN READ

Thought Leadership

Inspired by what you’re reading? Why not subscribe for regular insights delivered straight to your inbox.

From 2024, the UEFA Champions League will undergo its most significant format change since the rebranding of the competition in 1992, moving to a ‘Swiss-style’ group stage before the knockout stages. Much of the commentary around the reforms has focused on the increased volume of matches, with 36 teams in a single group now playing 10 group stage games each against 10 different opponents, generating 180 fixtures compared to the 96 today.

From UEFA’s perspective, the Swiss Model is a practical solution to fulfilling the objective of expanding the competition while still delivering a workable schedule. It enables flexibility in the number of matches played by each team, meaning that the size and length of the competition can be made to fit to the existing schedule, rather than the other way around. While the new competition, because of its increased size, is disruptive to domestic leagues, it is less disruptive than it would have been had the solution been to expand the competition using the existing structure by increasing group sizes or the number of groups.

The Swiss model is clearly a pragmatic way to deliver an expanded UCL, but its long-term commercial success hinges on the extent to which the competition excites fans. At Twenty First Group we specialise in quantifying the drivers of fan interest and commercial value: quality of players and teams, jeopardy of outcomes, and fan connection with the narratives.

As shown by the TFG Flywheel below, the combination of increased quality, jeopardy and connection can lead to increased long term commercial value for rights holders, and this is something that UEFA will be hoping to maximise with the Champions League restructure.

We have used our Intelligence Engine to simulate and quantify the impact of the changes in the competition’s ability to ignite the passion of fans.

Quality

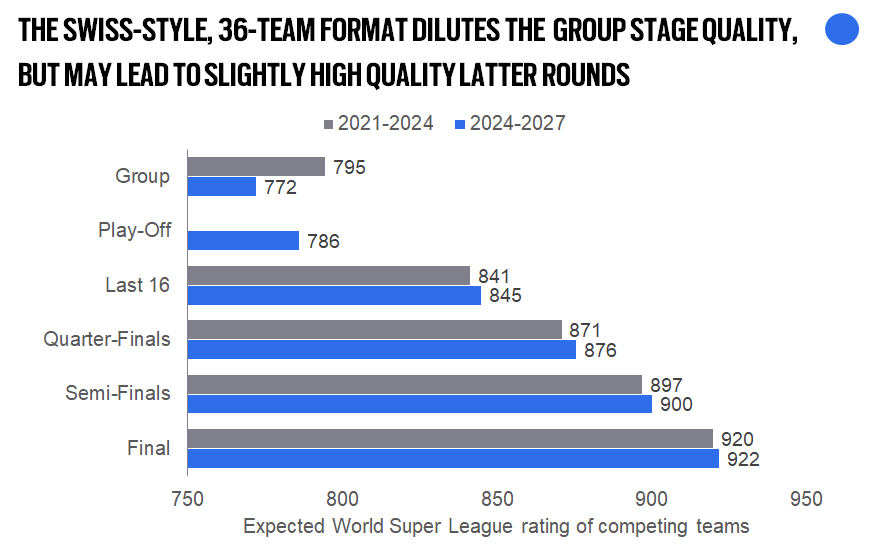

Depending on how access to the competition is granted, the move to 36 teams will likely have a small but significant negative impact on the average quality of games in the group stages. However, a combination of implementing a playoff round and the increased number of matches for each individual team reduces the role of good or bad luck influencing a team’s overall outcome, meaning that the cream has a slightly better chance of rising to the top. As a result, our modelling suggests that the quality of teams in the knockout rounds may increase marginally, though it remains to be seen how these clubs will manage their squads in light of an increased number of high-intensity matches throughout the season – increasing demands on the top players may result in greater rotation, negatively impacting on the average quality of teams.

Jeopardy

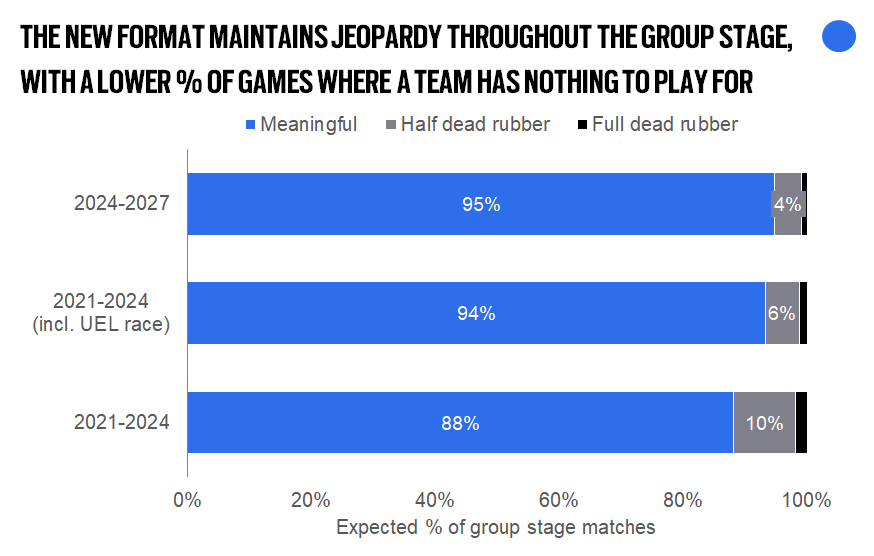

One concern is that the increased number of games will lead to a raft of dead rubbers in matchdays nine and ten, but our analysis suggests that this is unlikely to be the case. The use of qualification and seeding cut-offs at 8th, 16th, and 24th place is likely to mean that 95% of matches will be ‘meaningful’- i.e. both teams having something to play for. Just 1% of games in the group stages will be dead rubbers, played between two teams whose position (or lack thereof) in the next round has already been decided. In terms of jeopardy the Swiss-style format is actually an improvement on the current format and is its key strength.

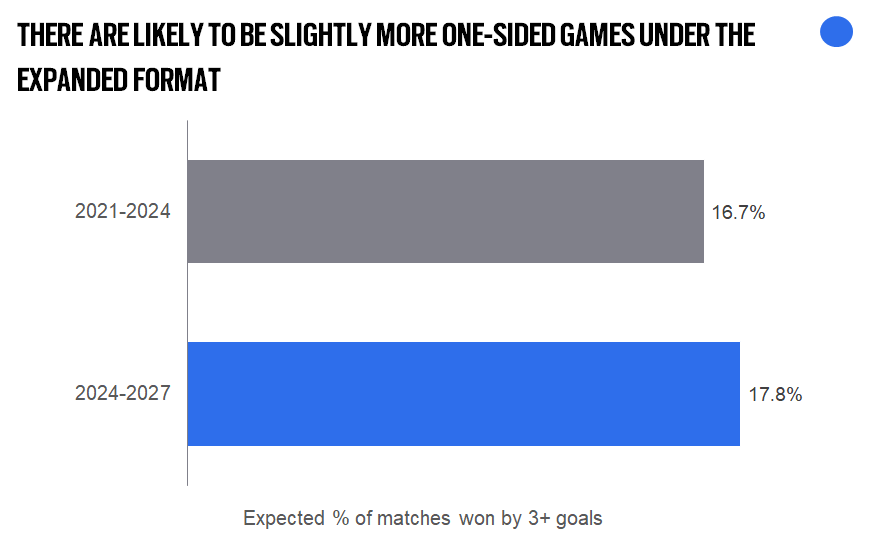

However, one consequence of the competition’s expansion is the increased share of games that are likely to be one-sided. In absolute terms there will likely be a close to double the number of games that are won by three or more goals, meaning at an individual match level jeopardy is likely to fall.

Connection

Connection is delivered through compelling narratives, both through delivering ‘best vs’ best’ contests with sufficient scarcity so that they remain compelling and through stories that keep the magic of sporting competition alive, such as Ajax’s glorious run to the semi-finals in 2018/19. Our models suggest that the chances of a non-big 5 team reaching the semis – as Ajax did – will be broadly the same under the Swiss Model as it is today.

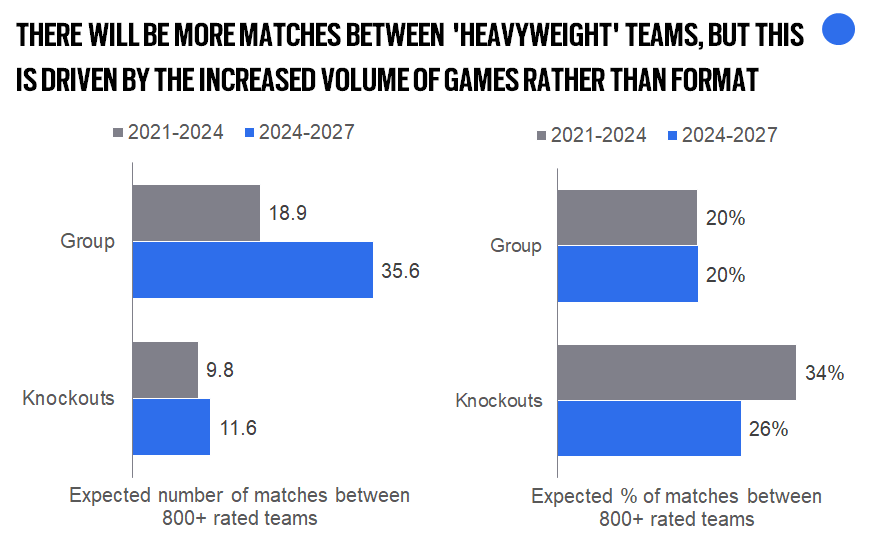

In terms of ‘best vs best’, the new format significantly increases the number of games between teams rated 800+ in TFG’s World Super League model (typically the 16-20 biggest, best, and most commercially attractive clubs). However, this is driven entirely through the fact there will be 88% more group stage matches and 55% more knockout matches. So while fans will be treated to more ‘heavyweight’ clashes in total, this will fall as a share of all matches in the competition potentially undermining the scarcity value of such contests.

Conclusion

More matches will undoubtedly drive short-term value for the UEFA Champions League as broadcasters seek an opportunity to drive stickier subscriptions, and advertising income.

The Swiss model may deliver long term success too, as the competition will retain its status as the highest-quality competition in football, producing more matches between Europe’s biggest and best teams. The new format delivers jeopardy throughout the competition, keeping stakes high and fans entertained, also creating the potential for narrative value through ‘as it stands’ analysis as the final match rounds unfold. While the expansion is not without risk – the reduction of the ‘scarcity premium’ and the impact this has on the ability of fans to remain excited by and willing to pay for ‘yet another’ heavyweight clash – the Champions League will continue to excite fans throughout the next cycle.

Domestic leagues will undoubtedly view the competition’s expansion and scalability of its format as a threat to their own position and revenues. That the competition’s expansion is being delivered without undermining the attractiveness of the sporting product may give further cause for concern.

If you would like to find out more about our competition structure services please get in touch with Ben Marlow or Omar Chaudhuri.

Read an example of our competition structure work here.